NEW YORK (CNNMoney) -- U.S. stocks were headed for a flat open Monday, as investors remain on edge at the start of big week for central banks around the world.

Expectations are high that the U.S. Federal Reserve and the European Central Bank will announce new measures to boost the economy when they meet later this week, as the U.S. slowing recovery and Europe's growing debt crisis continue to plague markets.

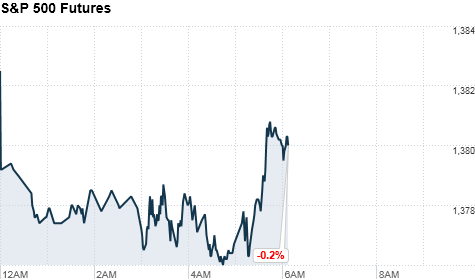

Early Monday, Dow Jones industrial average and S&P 500 futures were down between 0.2% and 0.3%, while Nasdaq futures were up slightly.

The economic situations in the United States and the eurozone will remain in focus this week as the Fed and ECB hold their monetary policy meetings. The Fed's two-day meeting culminates in an announcement on monetary policy Wednesday.

Once the Fed wraps up, the ECB will take center stage as the central bank's Governing Council meets in Frankfurt on Thursday. Investors will keep a close eye on ECB president Mario Draghi to see if he will announce any concrete steps to help relieve pressure in the eurozone, following hints for more aggressive and unconventional intervention during a speech last week.

Stocks rallied Friday on talk that the ECB may intervene in the bond market to ease borrowing costs for Spain and Italy. Investors also took in government data showing the U.S. economy grew at a slightly faster rate in the second quarter than economists were expecting.

The Dow Jones industrial average climbed to end above the 13,000 mark on Friday, a psychologically important level it had not crossed since early May. The S&P 500 also ended at its highest level since May.

World markets: Britain's FTSE 100 rose 0.6%, the DAX in Germany added 1.1%, while France's CAC 40 gained 0.8%.

Spain's economy continued to shrink for a third straight quarter. The struggling country's GDP fell 0.4% during the second quarter. Lately Spain has been in the spotlight thanks to its soaring borrowing costs. The Spanish 10-year yield neared 8% last week, but has since pulled back amid hopes that the ECB will intervene to help bring down the country's borrowing costs.

Asian markets ended mixed. The Shanghai Composite slid 0.9%, while the Hang Seng in Hong Kong gained 1.6% and Japan's Nikkei rose 0.8%.

Economy: There are no major economic reports scheduled Monday.

Companies: Shares of HSBC (HBC) were slightly higher in early trading Monday after reporting its six-month profit beat estimates. The London-based bank put aside about $2 billion to compensate UK customers for misselling of payment-protection insurance. The provisions are also intended to cover the cost of "certain law enforcement and regulatory matters," after a U.S. Senate report this month criticized HSBC for failing to prevent billions of dollars worth of money transfers that Senate investigators believe were linked to drug cartels and terrorist groups.

CIT Group (CIT, Fortune 500) is scheduled to report quarterly earnings before the opening bell, with analysts surveyed by Thomson Reuters expecting the financial services company to report a loss of 46 cents per share.

Fiserv (FISV) will report results after the market close, and the financial analytics firm is predicted to post earnings per share of $1.26.

Currencies and commodities: The dollar rose against the euro and the British pound, but fell slightly versus the Japanese yen.

Oil for September delivery gained 9 cents to $90.22 a barrel.

Gold futures for August delivery rose 70 cents to $1,618.70 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 1.55% from 1.56% late Friday.

No comments:

Post a Comment