NEW YORK (CNNMoney) -- U.S. stocks fell at the open Thursday as disappointing economic news out of the United States renewed worries about a global slowdown.

Initial jobless claims missed analyst expectations, coming in unchanged for the week ended August 25. Personal income and spending both increased in July, but spending came in lower than analysts had forecast.

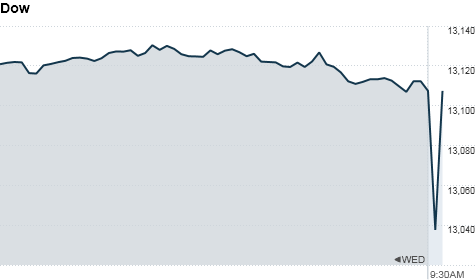

The Dow Jones industrial average, the S&P 500 and the Nasdaq declined 0.6%.

Many investors have been holding off on making any big bets before Friday, when Federal Reserve chairman Ben Bernanke speaks in Jackson Hole, Wyo. Observers will be looking for hints from Bernanke about the possibility of new stimulus measures.

Europe is once again in focus following an auction of 5- and 10-year Italian bonds Thursday morning. Italy's borrowing costs fell, signaling that investors are more confident that the European Central Bank will stage a major intervention in the bond market.

A Wednesday op-ed by ECB president Mario Draghi added to that optimism, as he reiterated that "exceptional measures" are justified to stabilize financial markets.

Energy markets will also be in focus, with Hurricane Isaac curtailing oil production along the Gulf of Mexico.

U.S. stocks ended with slim gains Wednesday, as many investors remain sidelined or on vacation.

World Markets: European stocks slid in afternoon trading. Britain's FTSE 100 shed 0.3%, the DAX in Germany fell 0.8% and France's CAC 40 edged lower 0.3%.

The European Commission's Economic Sentiment Indicator fell in August, as European consumers continue to lose confidence in the eurozone, particularly when it comes to retail trade and construction managers.

The Business Climate Indicator, however, edged higher, helped by an improvement in managers' assessments of exports and past production.

Meanwhile, Asian markets ended lower Thursday. The Shanghai Composite was flat, while the Hang Seng in Hong Kong lost 1.2%, and Japan's Nikkei fell 1%.

Economy: The Labor Department reported that number of Americans filing for first-time unemployment totaled 374,000 during the week ending August 25, unchanged from the previous week's revised figure. Claims were expected to total 370,000, according to a survey of analysts by Briefing.com.

The Bureau of Economic Analsysis said personal income increased $42.3 billion, or 0.3%, in July, in line with Briefing.com's consensus.

Personal consumption expenditures increased $46 billion, or 0.4%, for the month. That was slightly below the 0.5% increase expected by economists polled by Briefing.com.

Companies: Barclays (BCS) named Antony Jenkins as the bank's new chief executive Thursday morning. Jenkins currently leads Barclays retail and business banking business. Former Barclays CEO Bob Diamond resigned in July amid a scandal over the manipulation of Libor rates. Shares of the bank were edged lower.

Related: Barclay's goes in-house for new CEO

Same-store sales data from several leading retailers, including Macy's (M, Fortune 500), Costco Wholesale (COST, Fortune 500), Target (TGT, Fortune 500) anGap Inc (GPS, Fortune 500), exceeded expectations.

After the closing bell on September 4, Sears Holdings Corp (SHLD, Fortune 500). will no longer be trading in the S&P 500, since the number of public shares in the hands of investors has been well below the 50% threshold required for inclusion for some time. It will be replaced by LyondellBasell (LYB), which manufactures chemicals and refines crude oil.

Shares of network equipment maker Ciena (CIEN) were down more than 13% following disappointing second-quarter earnings.

Pandora (P) shares jumped nearly 20%, as the music streaming service said it broke even in its most recent quarter.

Currencies and commodities: The dollar lost ground against the euro, the British pound and the Japanese yen.

Oil for October delivery fell 36 cents to $95.13 a barrel.

Gold futures for December delivery rose 40 cents to $1,665.50 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 1.62% from 1.65% late Wednesday.

No comments:

Post a Comment