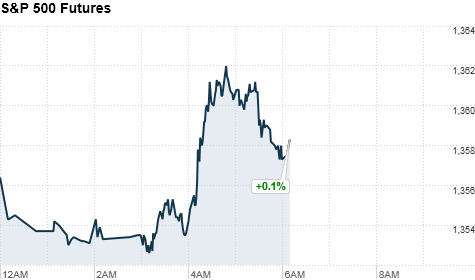

NEW YORK (CNNMoney) -- U.S. stocks pointed to a flat open Monday, as investors wade through economic reports from Europe and China, ahead of U.S. manufacturing data.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures hovered around breakeven Monday morning. Stock futures indicate the possible direction of the markets when they open at 9:30 a.m. ET.

Europe will continue to be in focus this week.

Eurostat released numbers on May unemployment, which reached a new record of 11.1% as 88,000 people were added to the jobless pool.

Last Friday, EU leaders announced a "breakthrough" deal out of their two-day summit, saying they will take steps to stabilize eurozone credit markets and strengthen the region's banking system. But many of the details have yet to be finalized, and implementing the plans could prove politically and legally difficult.

In China, the National Bureau of Statistics in Beijing said Sunday morning that the Manufacturing Purchasing Managers Index for June fell to 50.2 from 50.4 in May. Any reading below 50 signals contraction in the manufacturing sector.

Investors are keeping a close eye on this figure, given concerns about the country's slowing growth.

On the domestic front, investors are waiting for several reports on U.S. manufacturing and construction. Later this week, the Bureau of Labor Statistics will release the all-important jobs report for June.

Friday marked the end of the first half of the year, with all three indexes posting strong gains. The Dow rose 5.3%. The Nasdaq surged 12.5%, and the S&P added 8%.

World markets: European stocks were higher. Britain's FTSE 100 (UKX) rose 0.5%, the DAX (DAX) in Germany added 0.8% and France's CAC 40 (CAC40) grew 0.9%.

Asian markets ended mixed. The Shanghai Composite (SHCOMP) ended just above breakeven, while Japan's Nikkei (N225) closed slightly lower. Hong Kong markets were closed for holiday.

Economy: The Institute of Supply Management will report its monthly manufacturing index at 10 a.m. ET. Economists surveyed by Briefing.com forecast the index will fall to 51.5, down from 53.5 in May. Any reading above 50 indicates growth in the sector.

May's construction spending will also come out at 10 a.m. ET. The number is expected to fall slightly to 0.2%, from 0.3% in April.

Companies: Barclays (BCS) on Monday announced the resignation of its chairman, Marcus Agius, in the widening scandal surrounding the bank's manipulation of interbank lending rates in 2008 and 2009. Shares were up more than 3% in premarket trading.

Nike (NKE, Fortune 500) shares tumbled 9% on Friday, after the company reported quarterly earnings that missed analyst estimates.

Shares of Research In Motion (RIMM) fell 19% on Friday, after the BlackBerry-maker reported a huge quarterly loss, layoffs and another delay of its long-awaited BlackBerry 10 operating system.

Currencies and commodities: The dollar rose against the euro and British pound but fell versus the Japanese yen.

Oil for August delivery dropped $1.62 to $83.34 a barrel.

Gold futures for August delivery fell $13.90 to $1,590.30 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 1.63% from 1.66% on Friday.

No comments:

Post a Comment