NEW YORK (CNNMoney) -- U.S. stocks floundered Friday, as investors remain uneasy about the economy and whether the Federal Reserve will step in with any stimulus measures to fuel growth.

Analysts say better-than-expected U.S. economic data were giving markets a slight boost, but also dimming hopes that the central bank will announce further action at its annual symposium next week in Jackson Hole, Wyo.

"Any indicator that the economy is ticking just slightly higher in terms of modest growth plays into the hands of the Fed," said Peter Cardillo, chief market economist at Rockwell Global Capital. "It buys the Fed more time not to announce new stimulus."

Few expect Fed Chairman Ben Bernanke to reveal specific new intervention measures at Jackson Hole, but minutes from the Fed's last meeting released earlier this week suggest the central bank is leaning more toward launching a third round of quantitative easing, or QE3.

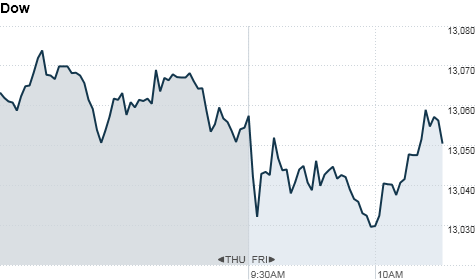

The Dow Industrial Average, S&P 500 and Nasdaq moved slightly higher, after dipping lower earlier.

Europe was also in focus Friday as Greek Prime Minister Antonis Samaras wrapped up a meeting with German Chancellor Angela Merkel in Berlin.

Merkel reiterated her support for Greece to stay in the eurozone, but said that the debt-strapped country needs to meet its reform targets, and that she will wait for the report by the European Union, International Monetary Fund and ECB, known as the troika, which is due next month. Samaras will meet with French President Francois Hollande Saturday.

In the United States, trading volume has been light for weeks, which is typical in August. Most expect that trend to continue through Labor Day.

World Markets: European stocks were lower in afternoon trading Friday. Britain's FTSE 100 slipped 0.4%, the DAX in Germany declined 0.2%, and France's CAC 40 shed 1%.

Asian markets ended in the red. The Shanghai Composite lost 1%, the Hang Seng in Hong Kong dropped 1.3%, and Japan's Nikkei fell 1.2%.

Economy: Durable goods order rose 4.2% in July, more than the 2.5% increases analysts were expecting. But excluding transportation good, orders unexpectedly fell 0.4% last month, according to the Census Bureau.

Companies: In a ruling that will not affect the U.S. patent infringement trial now in the hands of a California jury but addresses many of the same issues, a South Korean court has delivered a split decision that slightly favors Samsung over Apple (AAPL, Fortune 500).

Related: Apple vs. Samsung: Three possible outcomes

Shares of software designer Autodesk (ADSK) slid 16% after the company reported disappointing earnings late Thursday.

Shares of Eli Lilly (LLY, Fortune 500) jumped after the drugmaker said that although its experimental Alzheimer's drug didn't meet its main goals, it did show significant improvement in some patients.

Currencies and commodities: The dollar rose against the euro, the British pound and the Japanese yen.

Oil for October delivery rose 20 cents to $96.47 a barrel.

Gold futures for December delivery dropped $2.60 to $1,670.20 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 1.65% from 1.68% late Thursday.

No comments:

Post a Comment