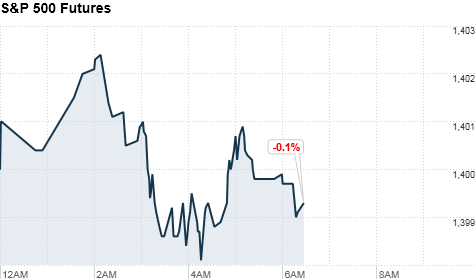

NEW YORK (CNNMoney) -- U.S. stocks were poised for a flat open Friday, as investors remain uncertain over whether the Federal Reserve will take steps to stimulate the economy amid rising concerns about global growth.

U.S. stock futures were barely changed.

Europe will be in focus Friday as Greek Prime Minister Antonis Samaras meets with German Chancellor Angela Merkel in Berlin and French President François Hollande in Paris. The Greek leader may request more time to implement the public cuts his country agreed to as part of its bailout program.

In the United States, trading volume is likely to remain light, which is typical in August. Little is expected to shake markets until the Federal Reserve's annual symposium next week in Jackson Hole, Wyo., from which investors are hoping to gain more clarity on the central bank's plans to keep the economy growing.

Earlier this week, minutes from the Fed's last meeting suggested that it is leaning more toward launching a third round of quantitative easing, or QE3. Economists and investors are wary though, since the economic data since the meeting has shown improvement.

Few expect Fed Chairman Ben Bernanke to reveal new intervention measures, but will be tuning in to his speech next week in Jackson Hole to figure out the Fed chief's next moves.

Thursday brought a sell-off in U.S. stocks, after Hewlett-Packard earnings disappointed and several reports showed the global economy slowing.

World Markets: European stocks were lower in midday trading Friday. Britain's FTSE 100 slipped 0.2%, the DAX in Germany declined 0.3%, and France's CAC 40 shed 0.3%.

Asian markets ended in the red. The Shanghai Composite lost 1%, the Hang Seng in Hong Kong dropped 1.3%, and Japan's Nikkei fell 1.2%.

Economy: The Census Bureau will release durable orders for July at 8:30 a.m. ET. Economists surveyed by Briefing.com expect the report -- which measures manufacturers' shipments, inventories and orders -- to show 3.5% growth, higher than the 1.3% growth in June.

Companies: In a ruling that will not affect the U.S. patent infringement trial now in the hands of a California jury but addresses many of the same issues, a South Korean court has delivered a split decision that slightly favors Samsung over Apple (AAPL, Fortune 500). Shares of Apple fell slightly in premarket trading.

Shares of software designer Autodesk (ADSK) will be in focus after the company reported disappointing earnings late Thursday.

Similar troubles hit computing company Salesforce.com (CRM), whose shares fell more than 5% in early trading Friday after missing earnings expectations.

Currencies and commodities: The dollar rose against the euro, the British pound and the Japanese yen.

Oil for October delivery fell 34 cents to $95.92 a barrel.

Gold futures for December delivery dropped $2.90 to $1,669.90 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 1.66% from 1.68% late Thursday.

No comments:

Post a Comment