NEW YORK (CNNMoney) -- U.S. stocks are set to open higher Thursday, as hope that the Federal Reserve will take further stimulus measures continues to give markets a lift.

Minutes released from the Federal Reserve's July meeting show the central bank is considering two key measures to boost the U.S. economy. Investors are likely to stay focused on the Fed, with attention on the Kansas City Fed's annual symposium in Jackson Hole, Wyo. next week.

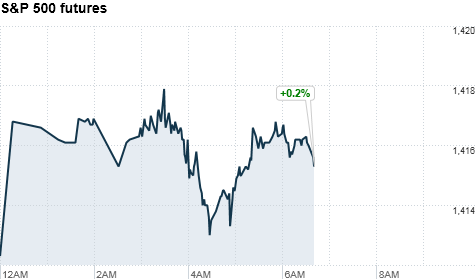

U.S. stock futures edged upward.

In Europe, investors will continue to watch Greek Prime Minister Antonis Samaras as he travels throughout the eurozone. On Friday, he will arrive in Berlin to meet with German Chancellor Angela Merkel. Samaras says he won't ask for more money, but he is expected to push for a two-year extension of the country's bailout program.

Wall Street trading volume is expected to stay light for the rest of August. U.S. stocks ended mixed Wednesday, trimming earlier losses following the Fed's release.

World Markets: European stocks moved higher in midday trading. Britain's FTSE 100 added 0.4%, the DAX in Germany rose 0.1% and France's CAC 40 ticked up 0.2%.

Manufacturing reports out Thursday show that Europe, while remaining in contraction, is improving. The Markit eurozone manufacturing purchasing managers index rose to a 4-month high. Separate reading for France and Germany reached their highest levels since the spring.

Asian markets ended higher. The Shanghai Composite ticked up 0.3%, the Hang Seng in Hong Kong gained 1.2%, and Japan's Nikkei rose 0.5%.

A preliminary report showed that China's manufacturing sector hit a nine-month low in August, according to HSBC, with a purchasing managers' index falling to 47.8 from 49.3 in July.

Economy: The Labor Department will release its weekly report on first-time unemployment claims at 8:30 a.m. ET. Economists surveyed by Briefing.com expect the claims to remain unchanged from last week at 365,000.

New-home sales figures from the Census Bureau are due at 10 a.m. ET. Economists surveyed by Briefing.com expect sales rose to an annual rate of 375,000 in July from 350,000 in June.

Companies: Shares of Big Lots (BIG, Fortune 500) suffered in after-hours trading Wednesday, falling more than 4%. The closeout retailer reports quarterly results Thursday morning.

Shares of computer maker Hewlett-Packard (HPQ, Fortune 500) tumbled more than 4% in after-hours trading Wednesday. HP reported better-than-expected quarterly earnings after the close, but issued disappointing sales and revenue forecasts.

Currencies and commodities: The dollar lost ground against the euro, was flat against the Japanese yen and edged higher against the British pound.

Oil for September delivery added 75 cents to $98.01 a barrel.

Gold futures for December delivery rose 10 cents to $1,616.50 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury slid, pushing the yield up to 1.72% from 1.69% late Wednesday.

No comments:

Post a Comment